How Bank MAS Transformed Digital Onboarding and Loan Approvals with VIDA

Case Study

By integrating VIDA’s digital identity stack, Bank MAS achieved faster, safer, and more seamless onboarding, enabling a 99.35% transaction success rate and an up to 99% acceptance rate in identity verification.

The Result

VIDA’s solutions brought measurable impact to

Bank MAS operations and customer satisfaction:

- 99.35% transaction success rate (as of December 2024), ensuring every customer interaction was reliable and friction-free

- Up to 99% acceptance rate in identity verification, enabling efficient and accurate onboarding of genuine users

These numbers translated directly into business results:

- Fewer abandoned applications

- Faster loan approvals

- Reduced risk from fraud and fake identities

- A more consistent, user-friendly journey from start to finish

With these improvements, Bank MAS was able to scale confidently, enhancing its digital reputation while maintaining regulatory trust and security.

Customer Experience Reimagined

VIDA didn’t just help Bank MAS improve its internal processes—it changed how customers experienced digital banking. What used to take multiple steps (and often failed) now happens in a smooth, single flow.

Users are onboarded faster. Loans are approved more easily. And trust is built at every interaction.

99,35%

Transaction success rate

99%

Acceptance rate in identity verification

The Challenge

![[Web Asset] Bank Mas_Challenge [Web Asset] Bank Mas_Challenge](https://vida.id/hs-fs/hubfs/%5BWeb%20Asset%5D%20Bank%20Mas_Challenge.png?width=1020&height=1275&name=%5BWeb%20Asset%5D%20Bank%20Mas_Challenge.png)

Bank MAS was aiming to provide a seamless and efficient onboarding journey. But they were hitting serious roadblocks:

- Lengthy verification steps were frustrating users.

- High drop-off rates meant fewer completed applications.

- Identity fraud and synthetic profiles posed growing risks.

In a competitive market, these issues weren’t just inconvenient—they were dangerous to growth. The bank needed a solution that could scale securely, without adding friction.

The Solution

![[Web Asset] Bank Mas_Solution [Web Asset] Bank Mas_Solution](https://vida.id/hs-fs/hubfs/%5BWeb%20Asset%5D%20Bank%20Mas_Solution.png?width=1080&height=1350&name=%5BWeb%20Asset%5D%20Bank%20Mas_Solution.png)

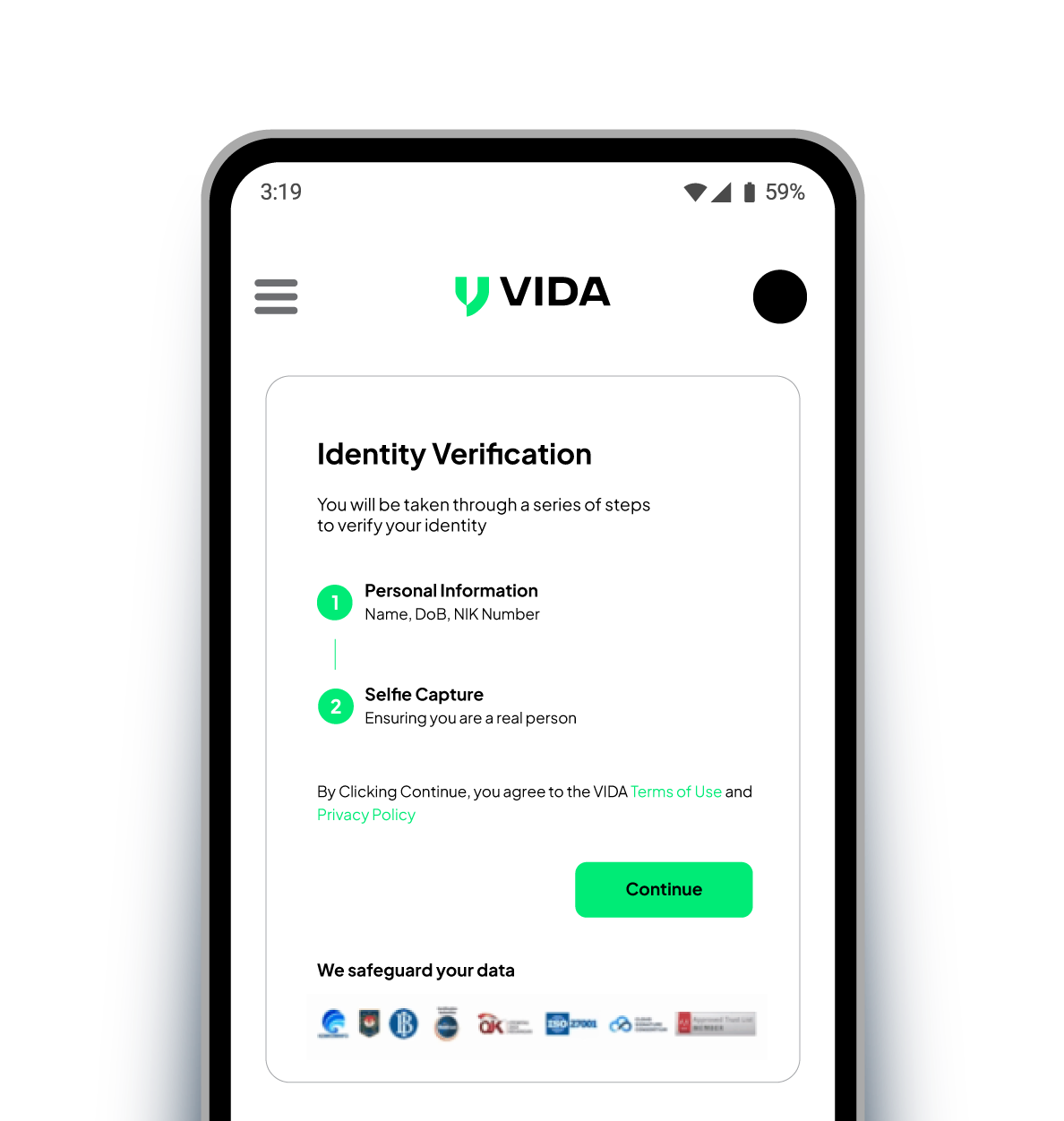

Bank MAS partnered with VIDA to implement a comprehensive digital identity verification stack, eliminating friction and fraud risks throughout the customer journey, VIDA deployed:

-

Real-time ID verification, replacing manual data entry with instant verification.

-

Liveness detection, ensuring only real users—not deepfakes or synthetic profiles—could access services.

-

Inline digital signatures, allowing customers to legally finalize applications instantly within the app.

-

Mobile SDK integration, ensuring the entire onboarding and loan approval process was smooth, fast, and user-friendly within the Bank MAS app.

This was more than a technical upgrade—it was a complete redesign of the customer experience, positioning Bank MAS as a digital-first leader.

Let’s Talk: Is Your Bank Ready for What’s Next?

VIDA helps financial institutions streamline onboarding, prevent fraud, and deliver user experiences that build trust and scale.

Reach out to see how VIDA can transform your digital onboarding journey.

One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Need help picking the right solution?

Trusted by Companies Across Industries