Bank Mas Achieves 99.35% Conversion Rate with VIDA’s

Digital Onboarding

Case Study

By integrating VIDA’s identity verification and digital signing solutions, Bank Mas streamlined its digital onboarding and loan application process, reducing drop-offs, increasing efficiency, and enhancing security while ensuring a seamless customer experience.

The Result

VIDA’s solutions significantly enhanced Bank Mas’ digital onboarding and loan application processes, driving measurable improvements in efficiency and security. With 99.35% transaction success rate (December 2024), the bank ensured smoother and more reliable customer interactions. The 73.19% acceptance rate in identity verification demonstrating increased efficiency in identity verification. Additionally, with 6.4K direct transactions per month, Bank Mas successfully scaled its operations, reinforcing its position as a leader in seamless digital banking.

Bank Mas now provides a faster, more secure, and user-friendly banking experience. With this transformation, customers benefit from a frictionless onboarding journey, reduced drop-offs, and a safer loan application process. This innovation strengthens the bank’s capability to deliver efficient and seamless financial services.

99,35%

Transaction success rate

73,19%

Acceptance rate in identity verification

6,4K

Direct transaction per month

The Challenge

In the highly competitive digital banking space, Bank Mas aimed to provide a seamless and efficient onboarding experience, particularly for loan applications. However, the bank faced several key challenges that hindered its ability to offer a smooth process. Lengthy verification steps resulted in high drop-off rates, while security concerns related to identity fraud and synthetic identities posed significant risks. Additionally, inconsistent conversion rates impacted the efficiency of digital transactions, creating bottlenecks in the customer journey. To remain competitive and provide a frictionless banking experience, Bank Mas needed a robust, secure, and high-performing digital identity verification solution.

The Solution

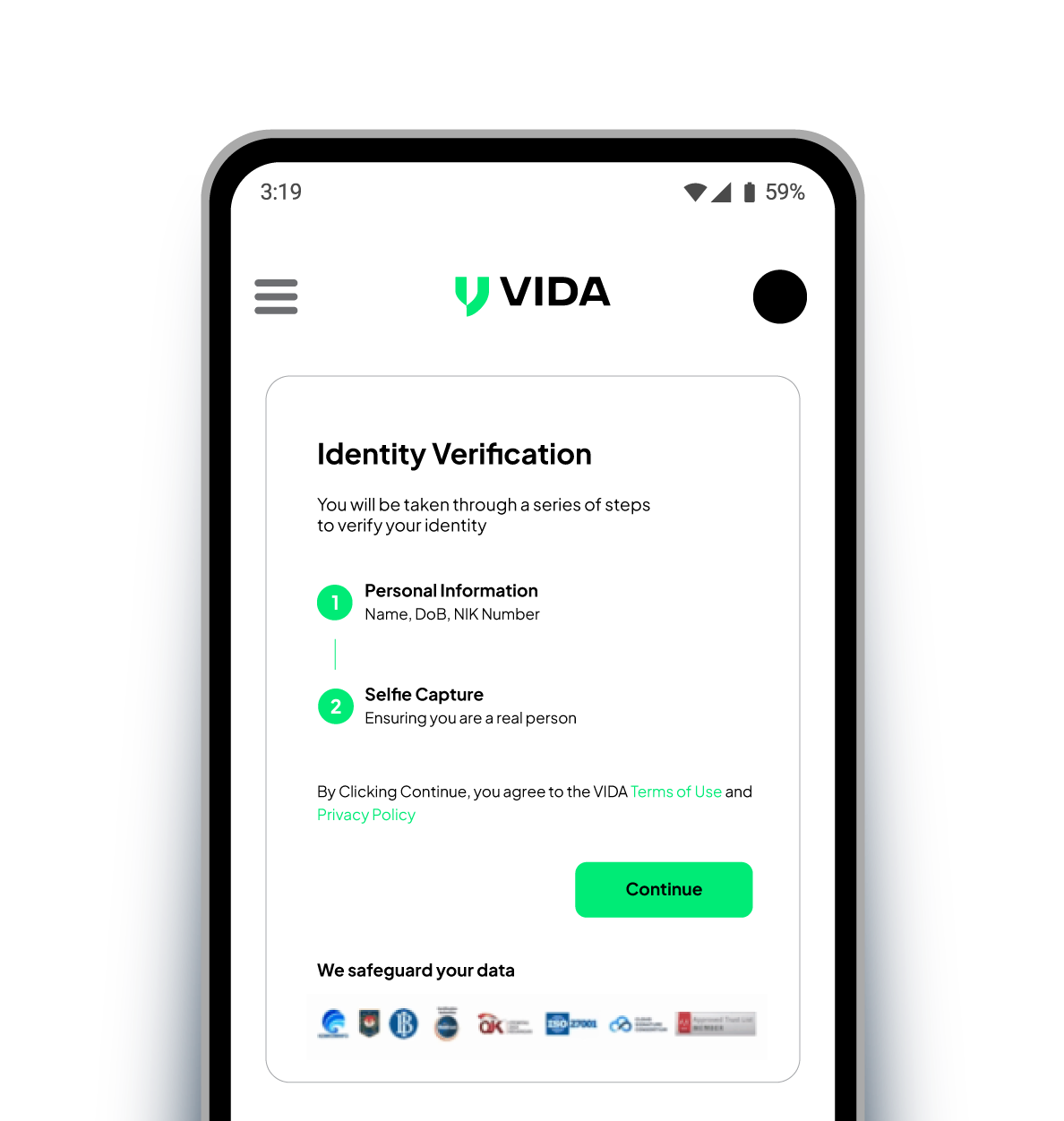

VIDA’s advanced technology was integrated into the Bank Mas' workflows, allowing for faster and more secure processing of loan applications.

- OCR Technology enabled instant and accurate data extraction from ID documents, eliminating the need for manual input and reducing errors.

- Liveness Mobile SDK ensured that only real users could complete transactions, mitigating the risk of identity fraud.

- Identity Verification authenticated customers in real-time, enhancing security and compliance.

- Inline Digital Signature allowed customers to sign agreements digitally, expediting the loan approval process without friction.

One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Need help picking the right solution?

Trusted by Companies Across Industries