Labamu is a fast-growing platform that helps small and medium-sized businesses (SMEs) in Indonesia manage operations, track sales, and process payments. Built to empower entrepreneurs with digital tools, Labamu’s mission is to simplify business for those who often face the most complexity.

But as Labamu grew and introduced premium features for advanced business users, they ran into a problem: too many users couldn’t complete the onboarding process.

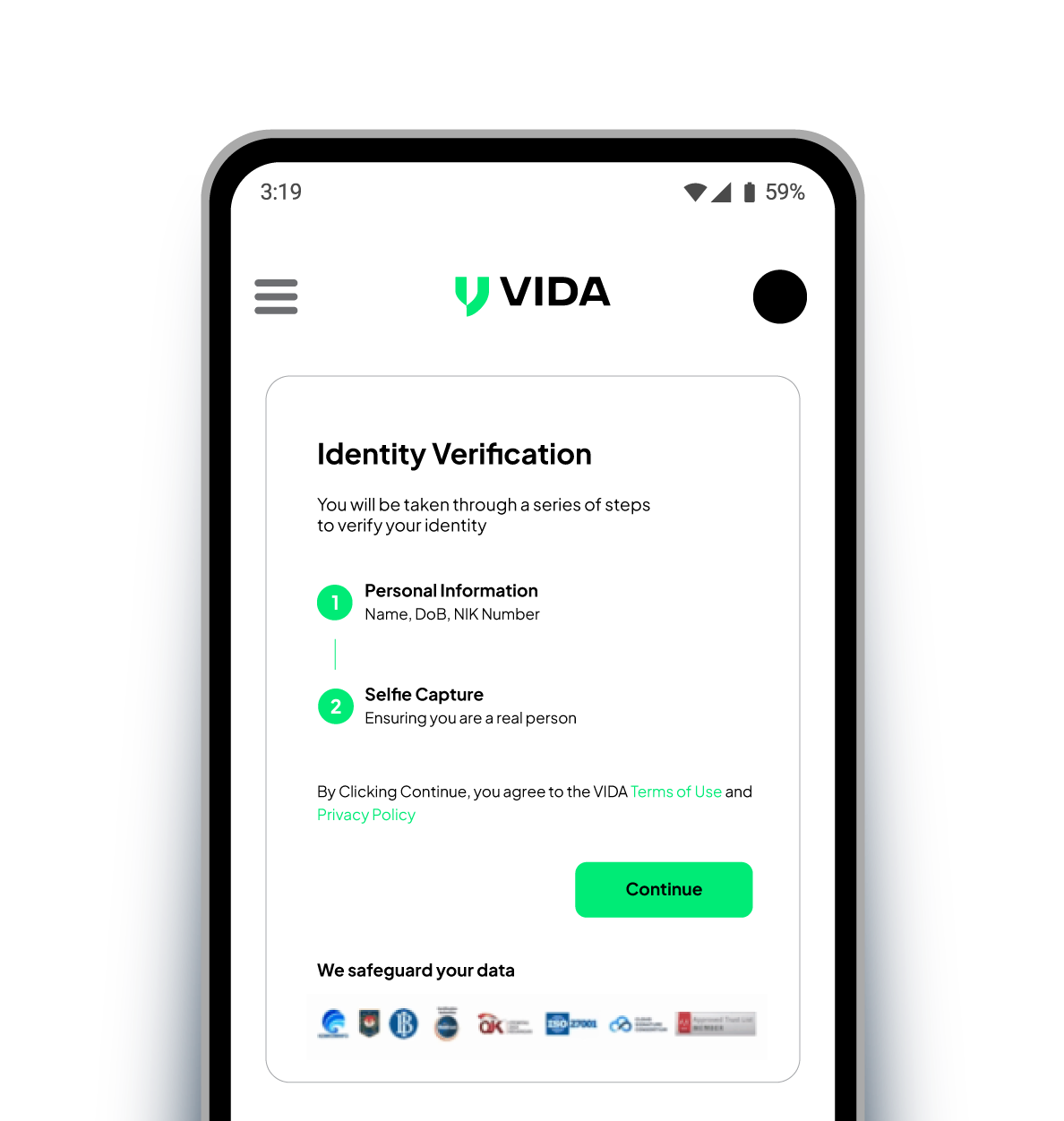

To keep growing sustainably—and securely—they turned to VIDA.