WOM Finance Transforms Operations with VIDA, Achieving 350K+ Transactions

Case Study

By integrating VIDA's advanced digital solutions through AdIns, WOM Finance

embarked on a transformative journey to digitize and streamline its multi-finance

processes. This strategic move aimed to replace outdated manual verification methods.

The Result

The strategic integration of VIDA Verify, through its partnership with AdIns, has been transformative for WOM Finance, delivering significant operational efficiencies and enhancing customer satisfaction. Automating over 99% of the onboarding process has streamlined operations, drastically reducing manual effort and resulting in an impressive throughput of over 350,000 transactions annually.

This leap in processing capability is complemented by an impressive 98% success rate in identity verification transactions, ensuring that WOM Finance maintains high standards of security and trust. These advancements have collectively elevated WOM Finance’s market position, enabling them to handle increased volume while improving overall customer experience.

The strategic integration of VIDA Verify into WOM Finance’s operations has not only optimized performance but also positioned the company as a leader in digital innovation within the multi-finance industry. WOM Finance now stands at the forefront of technological adoption, ready to meet future challenges with unmatched efficiency and reliability.

350K+

Annualized Transaction Value

>99%

Fully Automated Onboarding Process

>98%

Success Rate on Identity Verification Transaction

The Challenge

WOM Finance sought to digitize its manual onboarding and verification processes, which were slow and resource-heavy. To stay competitive, they needed a solution that could accelerate onboarding, ensure security, and maintain regulatory compliance, all while building customer trust.

VIDA's digital identity solutions, including eKYC and digital signature technologies along with the Power of Attorney (PoA) feature, enabled WOM Finance to streamline their verification processes.

The Solution

VIDA’s digital tools, including eKYC and digital signature technologies, were integrated into WOM Finance's processes. The introduction of a unique feature, the Power of Attorney (PoA), allowed branch managers to delegate signing authority to VIDA, speeding up approvals without the need for constant manager presence. This automation enabled a seamless and faster processing flow from the applicants through to the final approval.

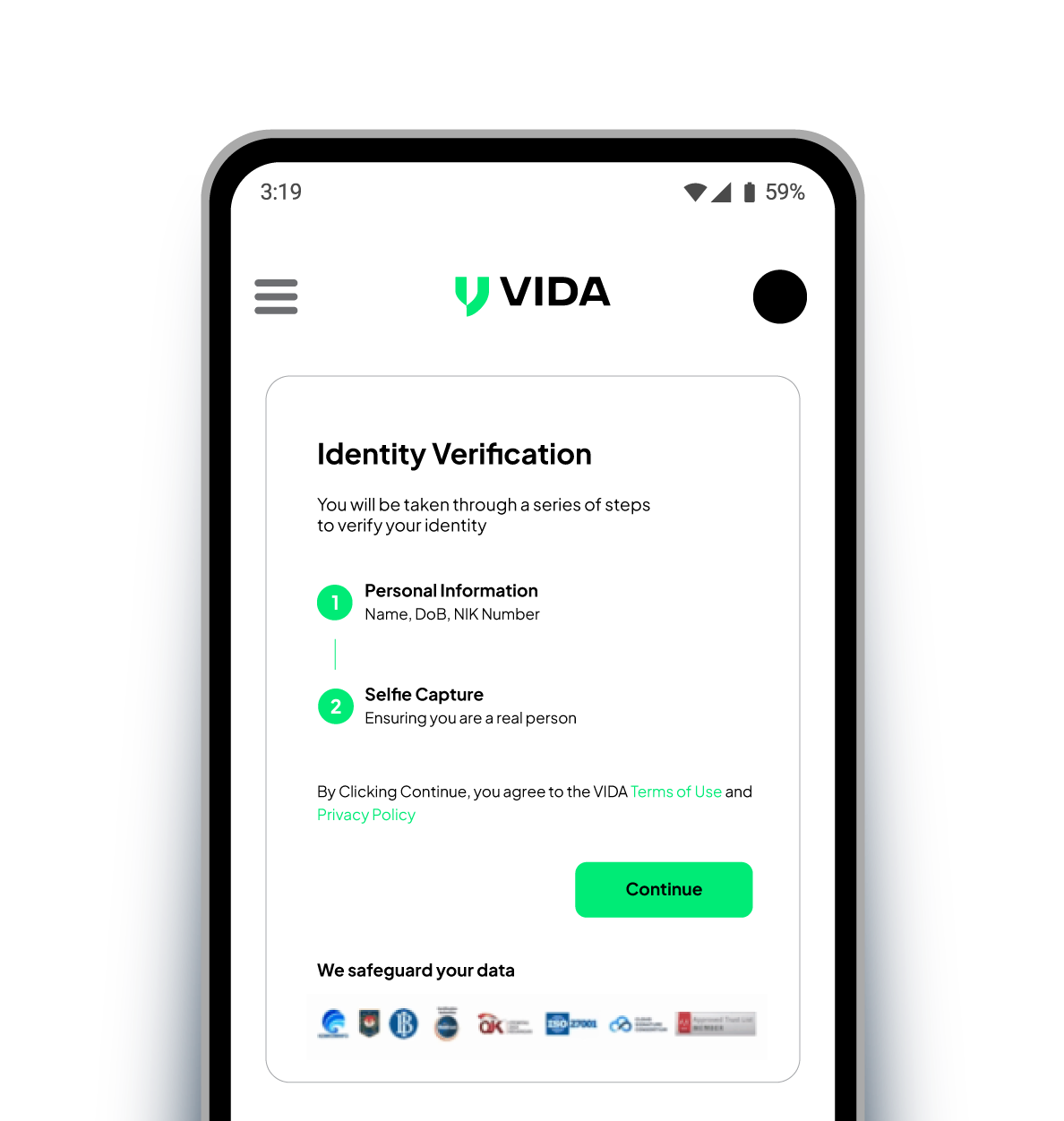

Your One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Need help picking the right solution?

"Quote"

xxxx

WOM Finance

Trusted by Companies Across Industries