PinjamYuk is a digital lending platform built to offer accessible, secure, and fast financial solutions to users across Indonesia. As the platform scaled its operations and user base, it needed to ensure that every loan application started with confidence, both from a regulatory perspective and in terms of user trust.

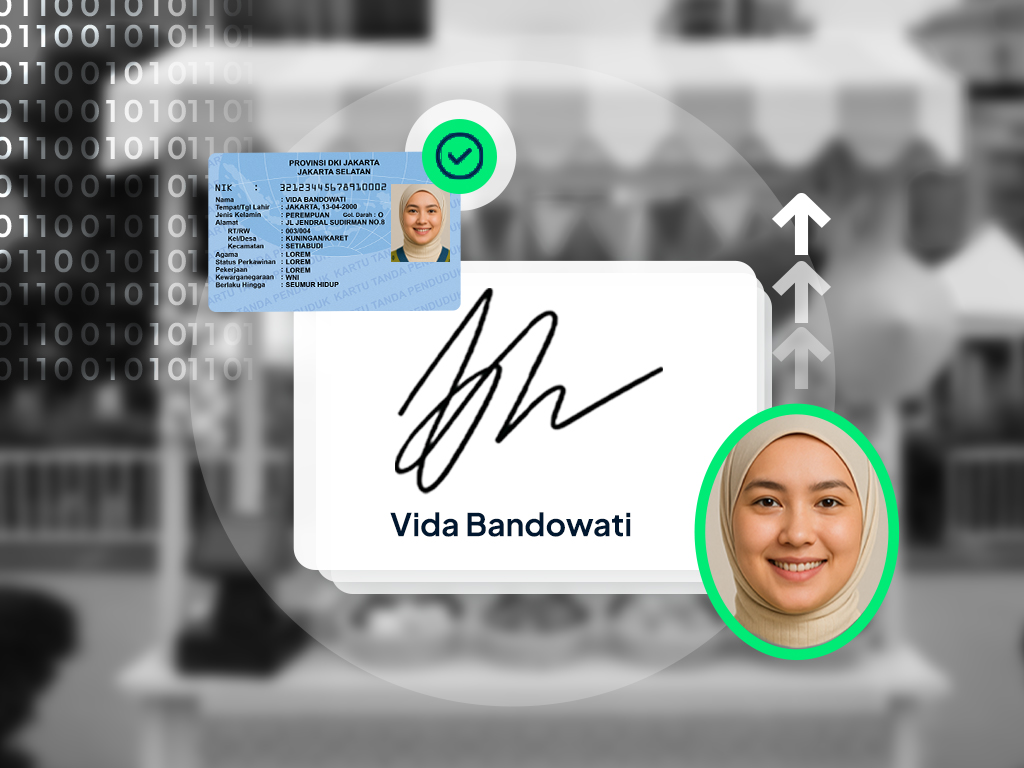

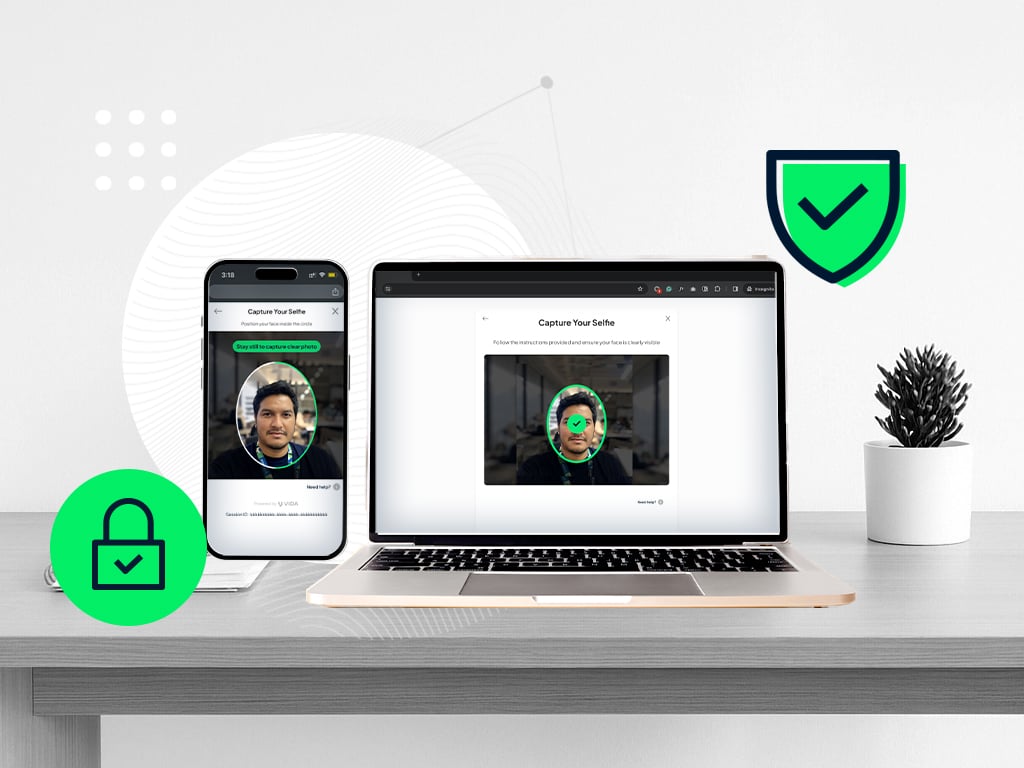

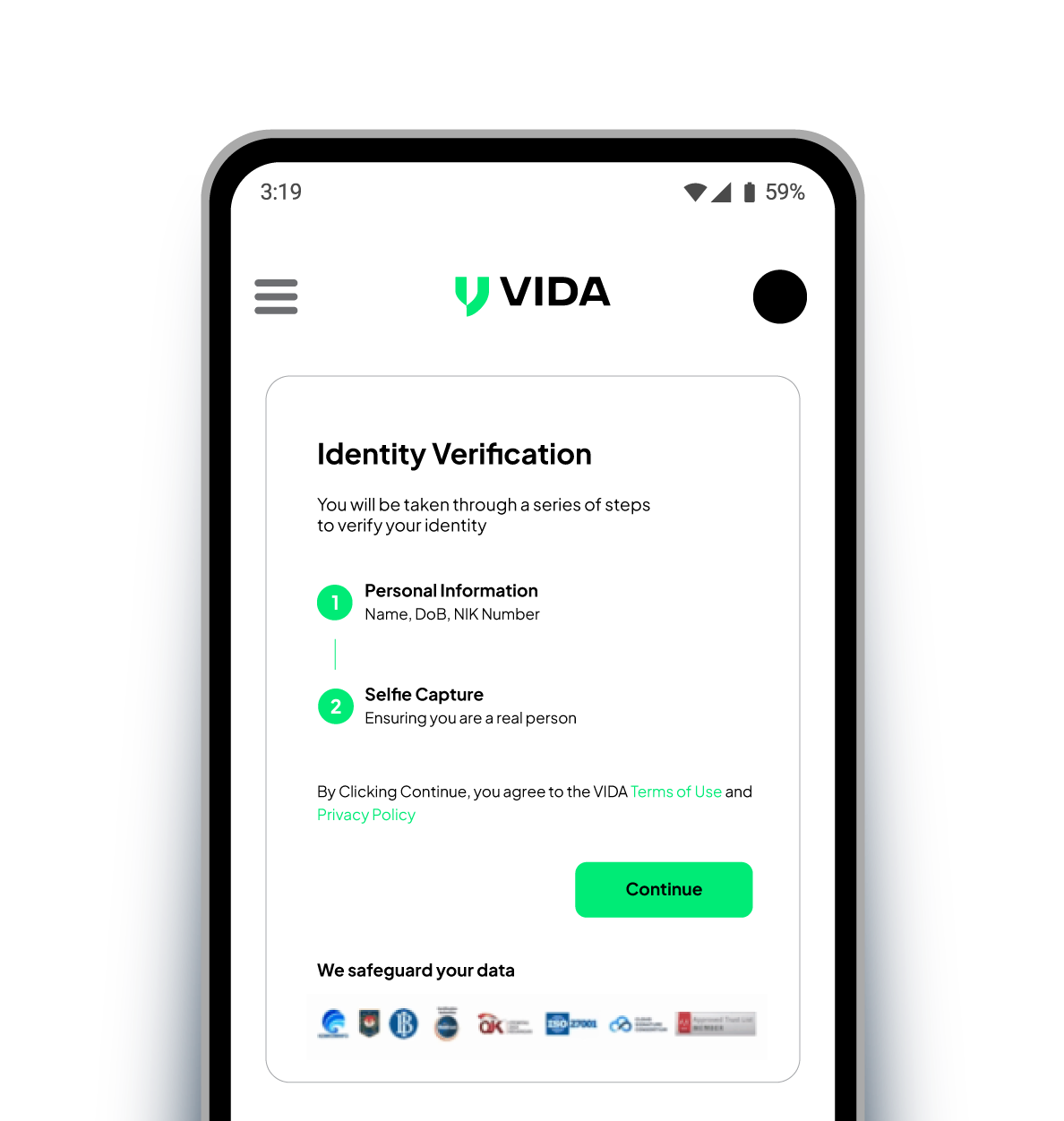

To support this, PinjamYuk partnered with VIDA to integrate secure identity verification and digital signatures into its onboarding process.