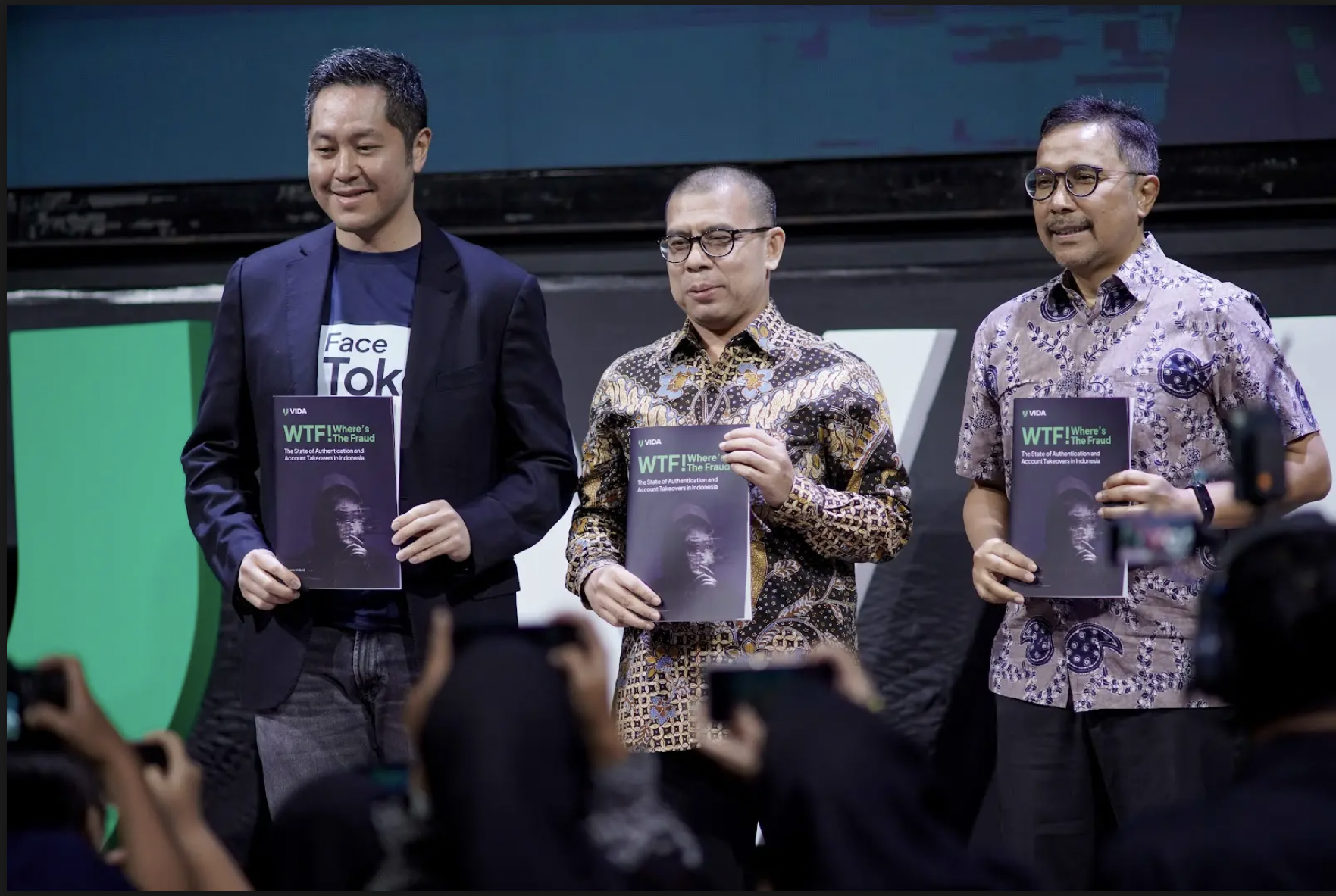

Jakarta, September 12, 2023 – PT Bank BCA Syariah (BCA Syariah) and PT Indonesia Digital Identity (VIDA) discussed developments in sharia digital banking transactions with journalists at the event ‘Media Gathering: Sharia Bank Creating a Reliable and Trustworthy Digital Ecosystem’ on September 12 in Jakarta. Present during the event were BCA Syariah Information Technology Director Lukman Hadiwijaya and VIDA Managing Director Adrian Anwar.

Digital transactions in the banking industry, including at sharia banks in Indonesia, are growing from time to time. This technology greatly helps in reaching new customers and increasing the penetration of sharia financial services in Indonesia.

As of July this year, the value of digital banking transactions in the country reached 5,035.37 trillion rupiah, or up 15.5% compared with the same period last year, according to Bank Indonesia (BI) data. Furthermore, Indonesia has become one of the countries in the Southeast Asian region with a continuously growing potential for digital transactions.

As a player in the sharia banking industry that is adaptable to technological developments, BCA Syariah seeks to provide practical solutions for consumers to help expedite financial transactions in accordance with their needs and lifestyle.

“During the first semester of 2023, the number of transactions at BCA Syariah reached millions, with mobile banking accounting for 63% of customer transactions. This demonstrates that the convenience of electronic banking services has become a must-have for customers,” said Lukman Hadiwijaya during the event. As a result, BCA Syariah continuously modernizes its digital services by developing various features that are more accessible to clients.

BCA Syariah is aware that one of the key challenges in digital transformation is transaction security. "We continually ensure that BCA Syariah's technological infrastructure meets the standards that can guarantee customers' security and convenience when using the features available on the BCA Syariah digital platform," Lukman added.

One of the features created by BCA Syariah is online account opening via BCA Syariah Mobile. Customers who want to open an account can do so from anywhere without having to visit branch offices. Potential customers who plan to open an account with BCA Syariah can do so by downloading the BCA Syariah Mobile application and filling out their information electronically. BCA Syariah guarantees the confidentiality and security of any client information recorded.

"With continuous development and innovation, we hope to make it easier for the public to access BCA Syariah products through electronic banking channels. This also represents BCA Syariah's commitment to promoting sharia financial inclusion in the country," Lukman said.

Managing Director of VIDA, Adrian Anwar, said, “The development of digital technology in the financial sector continuously evolves, making it easier for financial industry players to reach new customers quickly and accurately. VIDA serves as a provider of digital identity services based on electronic certificates, providing convenient digital identity services for businesses and individuals." He went on to say that VIDA provides secure protection of customer data in the financial industry, giving them confidence to engage in financial services activities through digital platforms. VIDA, as a provider of electronic certificates (PSrE) under the Ministry of Communication and Information Technology, provides individuals and institutions with secure and reliable electronic certificates and digital signatures, enabling safe and trusted interactions within the Indonesian digital ecosystem.

"VIDA has performed over 1.8 million biometric and liveness detection verification processes, with the capacity to handle up to 10 transactions per second. Dozens of digital technology organizations, including financial services, e-commerce, transportation, telecommunications, and healthcare, have used our products,” Adrian said.

.png)