Bank Raya Achieves 95%

Faster Account Openings with VIDA's Full Online Onboarding

Case Study

Bank Raya significantly improved its user onboarding process, optimized business operations,

and reduced operational costs.

The Result

Bank Raya's integration of VIDA Verify API has markedly enhanced its operational efficiency. By leveraging full online onboarding, the bank achieved a 95% faster account opening process. Adopting Auth Facematch technology further accelerated business processes by 85% and slashed operational costs by 95%, effectively minimizing queue times and reducing dependence on manual checks.

Bank Raya also saw a 99% reduction in fraud reports after implementing Liveness + Auth Facematch for authentication during PIN changes, password updates, and device changes. These enhancements significantly strengthened transaction security and increased customer trust.

Implementing the VIDA Verify API has significantly enhanced Bank Raya's customer onboarding process. This case study illustrates how advanced technology can elevate trust, reduce costs, and improve the user experience in the banking industry.

95%

Faster onboarding process

99%

Fraud reports reduction

95%

Operational cost reduction

85%

Faster business process

The Challenge

Bank Raya, a subsidiary of Bank Rakyat Indonesia, specializes in digital banking services for micro and small segments, pioneering digital loan disbursement with its product, Pinang.

Bank Raya faced a multifaceted challenge. Long account opening processing times when done offline, long queue times, and numerous user complaints when changing login devices were common issues. The manual verification process could take up to 48 hours. Additionally, there were frequent reports of potential fraud from internal checks and individuals, such as identities used for account opening or disbursement.

They required a solution to improve the user experience and optimize costs, balancing speed and security effectively.

The Solution

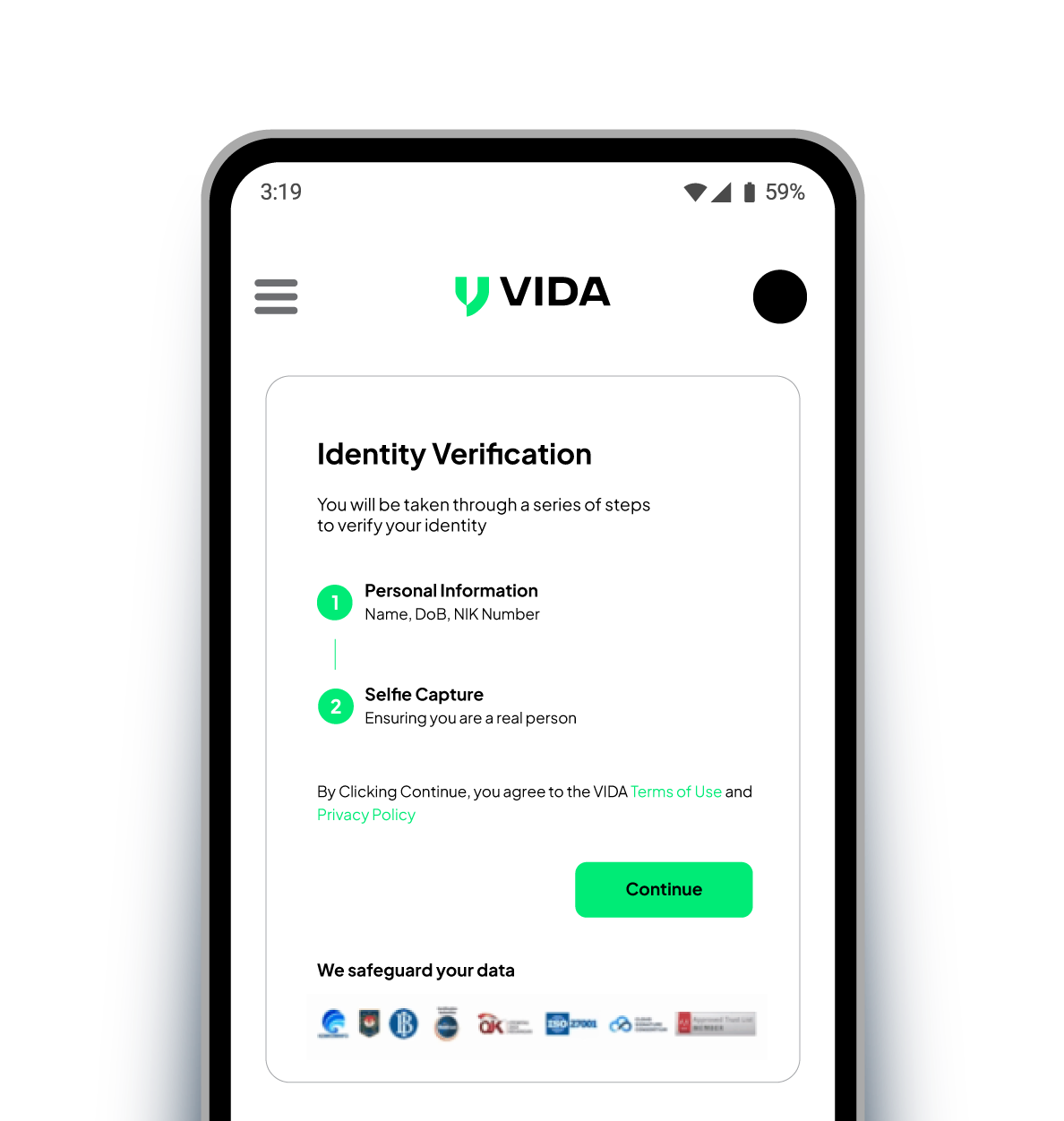

As a licensed Certificate Authority (CA), VIDA has established a robust infrastructure and expertise in biometric validation against authoritative databases. VIDA's solution could accurately expedite Bank Raya's user onboarding process without compromising security.

Our comprehensive solution balances speed and security while strongly emphasizing the user experience. By implementing VIDA Verify, Bank Raya can uphold its commitment to providing quick, secure, and user-centered financial services, thereby enhancing customer satisfaction.

Your One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Need help picking the right solution?

"Quote"

xxxx

Bank Raya

Trusted by Companies Across Industries