How It Works

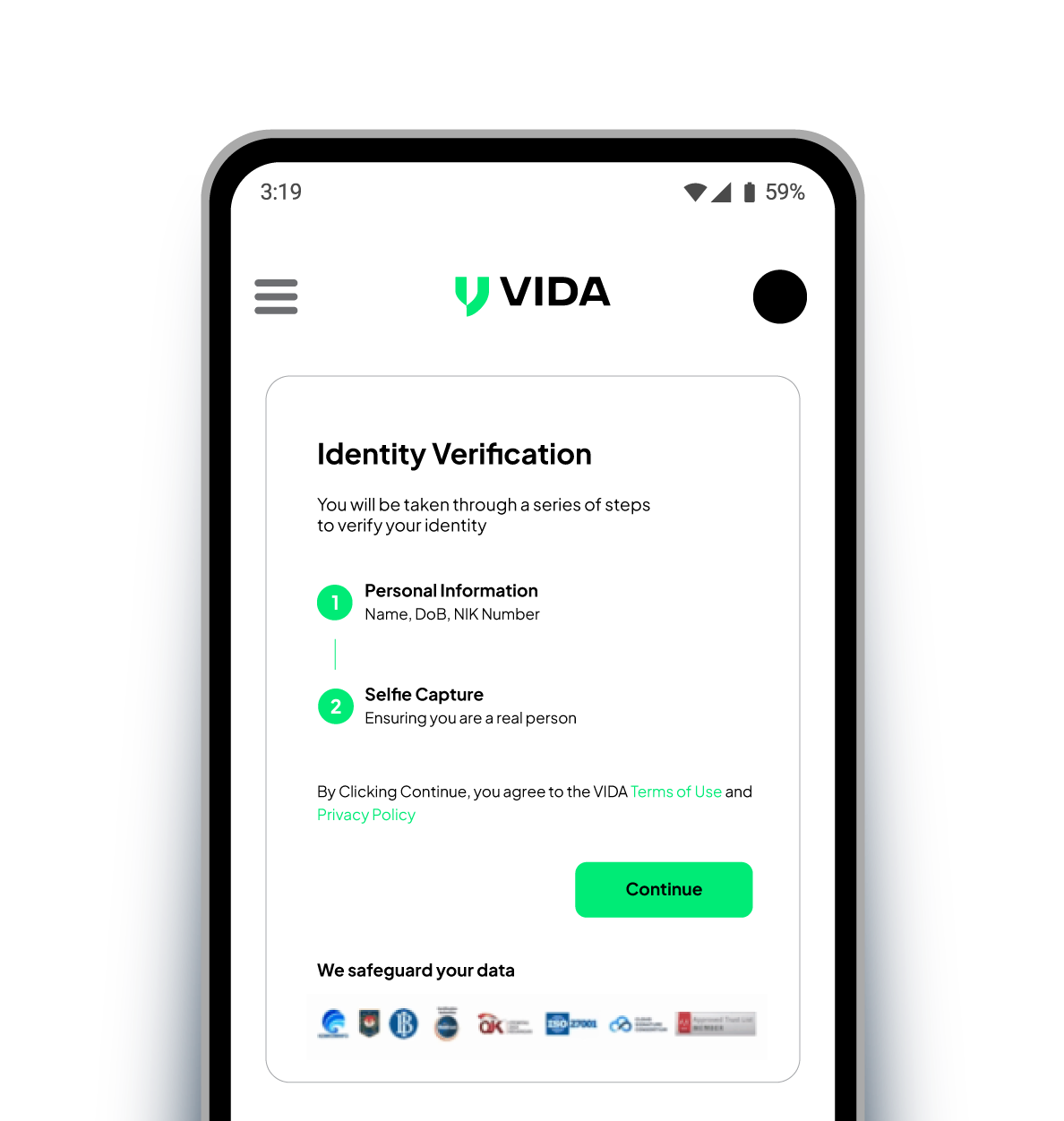

Application Submission

The user submits a loan or insurance application.

Data Verification and Credit Analysis

The user's data is verified and analyzed for credit assessment.

Verification with Authoritative Sources

Using the national ID number, the user's income is verified against authoritative sources.

Verification Results

The verification results are sent to the financial service.

Decision Making

Based on the verification results, a decision is made regarding the loan or insurance.

Implement Income Verification to Your Business

Income Verification enhances fraud prevention and by using authoritative sources for reliable data verification. Users submit loan or insurance applications, and within 2 seconds, real-time verification is completed and results are sent to the financial service. The API is available 24/7 and operates on a pay-per-use model.