Sinarmas Multifinance Achieves 83% Approval Rate with

Seamless & Secure Onboarding

Case Study

By integrating VIDA Verify, VIDA Sign, and SDK Liveness, Sinarmas Multifinance streamlined the car loan onboarding process, enhancing security, ensuring regulatory compliance, and delivering a smooth, reliable experience for applicants.

The Result

The impact of VIDA’s solutions was immediate and measurable:

83%

Conversion Rate

1.2K

Monthly Identity Verifications

2.5K

Monthly OCR Transactions

1K

e-Signatures Processed Monthly

Customers now complete their entire loan application process in a single day, boosting satisfaction while reducing operational strain on Sinarmas Multifinance.

The Challenge

Sinarmas Multifinance, a leading player in Indonesia’s multi-finance sector, aimed to simplify car loan applications while ensuring compliance with OJK (Otoritas Jasa Keuangan) regulations. However, their traditional paper-based onboarding process created significant roadblocks:

- Time-Consuming Approvals: Loan applicants faced delays due to manual verifications and document processing.

- Fraud Risks: Impersonation attempts, falsified documents, and identity fraud threatened security and trust.

- Customer Frustration: Lengthy back-and-forth processes led to drop-offs and dissatisfied applicants.

To keep pace with rising customer expectations and compliance standards, Sinarmas Multifinance aimed to implement a swift, secure, and fully digital onboarding experience.

The Solution

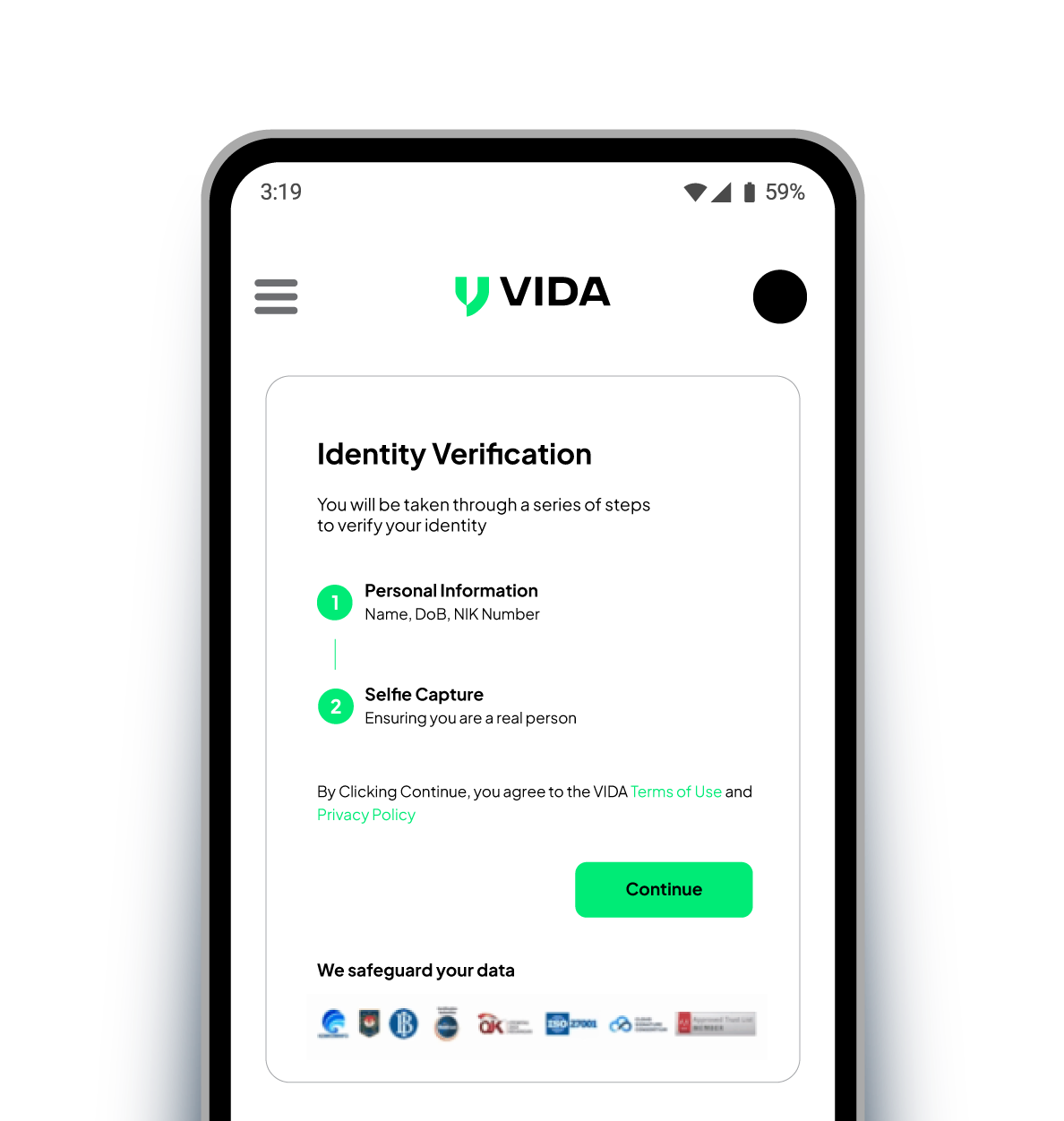

To tackle inefficiencies, security risks, and compliance demands, Sinarmas Multifinance established a partnership with VIDA to digitize its onboarding process.

- VIDA Verify: Verified applicants almost instantly, eliminating delays and ensuring only legitimate customers moved forward.

- SDK Liveness: Guaranteed that every applicant was physically present during the verification process, preventing impersonation and fraud.

- VIDA Sign (Inline & POA): Enabled customers to complete and sign loan agreements from any device, dramatically reducing approval times.

With VIDA’s technology, the loan application process became entirely digital, eliminating inefficiencies and strengthening fraud defenses.

Your One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Trusted by Companies Across Industries