Superbank Achieves the Milestone of 2 Million Customers with VIDA Identity Solutions

Case Study

Superbank’s rapid growth proves that high-volume onboarding and fraud-resistant identity verification can go hand in hand. With VIDA’s identity solutions, digital banks don’t have to choose between scale and security—they can have both.

The Result

Biometric AI & OCR-Powered Data Extraction

Guarantees precise identity verification, eliminating manual errors and adjustments. This leads to an enhanced user experience, ultimately boosting user conversion rates.

Tailored Regulatory Compliance Support

Enabled smooth MMN verification aligned with OJK requirements.

Scalable Infrastructure

Zero system disruptions, even during onboarding surges.

Breaking Barriers in Digital Banking with Seamless Identity Verification

For a fast-growing digital bank, the onboarding process is more than a formality, it’s the foundation of customer trust, regulatory compliance, and scalable growth.

Superbank, a forward-thinking player in Indonesia’s digital banking sector,

set an ambitious goal: onboard 1 million users within six months of its public launch and ensuring full compliance with OJK’s eKYC mandates.

By partnering with VIDA, Superbank didn’t just meet the target—they soared beyond it. They successfully doubled the target by achieving

2.7M

Total users in four months

Powered by VIDA’s secure eKYC

The Challenge

- High Rejection Rates Due to Data Mismatches – Biometric and demographic discrepancies led to onboarding friction, reducing first-attempt success rates.

- Scalability Concerns – As Superbanks anticipated rapid adoption, they needed an infrastructure capable of handling high-volume traffic spikes.

- Regulatory Compliance Complexity—Adhering to OJK’s eKYC framework required precise, accurate identity verification, including validation of MMN (Mother’s Maiden Name) against authoritative sources.

The Impact

VIDA’s seamless identity solutions enabled Superbank to break past their initial goals and achieve unprecedented scale:

- Grand Launch to Year-End – An additional 1.7 million users were successfully onboarded, doubling Superbank’s 2024 business target.

- Frictionless Customer Journey – Faster eKYC approvals meant higher customer satisfaction and increased engagement.

- Scalability Without Compromise – VIDA ensured zero system disruptions, allowing Superbank to handle high-traffic onboarding periods effortlessly.

“Kolaborasi dengan VIDA memungkinkan kami mengakuisisi 2 juta nasabah dalam 4 bulan. Teknologi VIDA mempercepat dan mengamankan verifikasi identitas, memastikan onboarding mulus serta memperluas akses perbankan digital.”

Bhavana Vatvani

Direktur Operasional Superbank

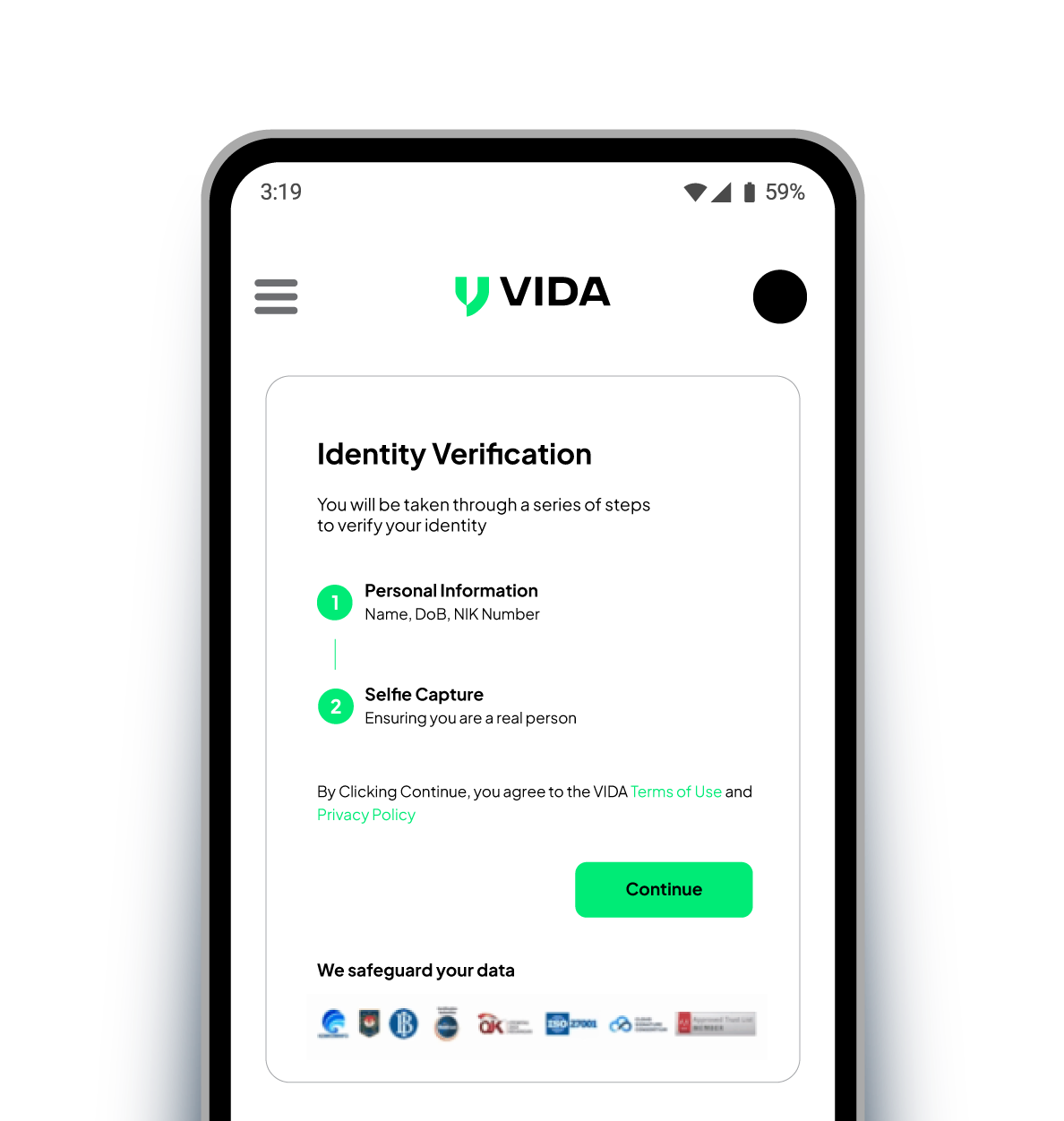

Your One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

Trusted by Companies Across Industries