Rupiah Cepat Achieves 100% Increase in Transactions with VIDA's Streamlined Onboarding

Case Study

By integrating VIDA's digital identity solution into its platform, Rupiah Cepat could significantly improve its user onboarding process and enhance overall customer satisfaction.

The Result

VIDA's solution significantly improved Rupiah Cepat's operational metrics. A success rate of 99.19% in processing API transactions and a high acceptance rate of 70.1% demonstrated the reliability of VIDA Verify. Rupiah Cepat also experienced a surge in conversion rates, doubling its annual transactions to over 1 million. By April 2023, the company was processing approximately 150,000 transactions per month.

With VIDA's robust verification process, Rupiah Cepat saw its fraud rates drop to under 20%, enhancing transaction safety and increasing customer trust. Moreover, VIDA's digital identity solution reduced Rupiah Cepat's Customer Acquisition Cost (CAC) by 28%, making operations more cost-effective and enabling more sustainable growth.

In summary, the implementation of VIDA Verify has considerably improved Rupiah Cepat's customer onboarding process. This case study demonstrates how advanced technology can boost trust, cut costs, and improve user experience in the digital lending industry. It sets a new benchmark for digital identity verification to revolutionize financial services.

100%

Increase in total transactions

28%

Reduction in Customer Acquisition Cost

20%

Slashed fraud rates

>99%

Success rate inprocessing API transactions

The Solution

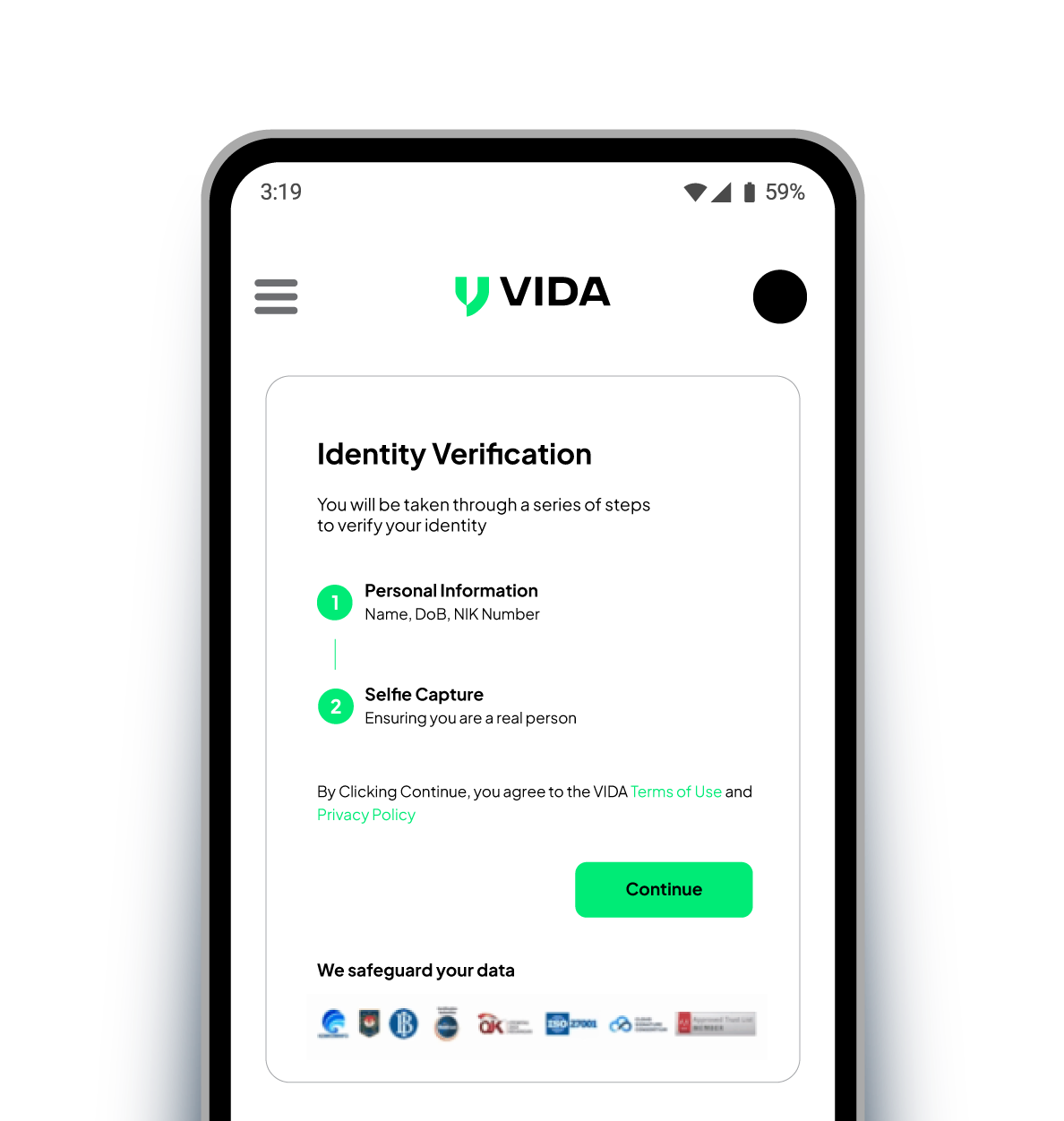

As a licensed Certificate Authority (CA), VIDA has established a robust infrastructure and expertise in biometric validation against authoritative databases. VIDA's solution could accurately expedite the user onboarding process for Rupiah Cepat without compromising security.

We also offered a comprehensive solution that balanced speed and security. This solution facilitated a smoother user onboarding experience and strengthened Rupiah Cepat's defensive posture against online fraud. VIDA Verify was a perfect fit for Rupiah Cepat, enabling the company to deliver on its commitment to provide quick, secure, and user-centered financial services. By integrating VIDA's digital identity solution into their platform, Rupiah Cepat could significantly improve their user onboarding process and enhance overall customer satisfaction.

Your One-Stop Solution for Customer Onboarding

With global top-ranked Face Recognition technology and legal identity database, enhance your customer experience with instant and secure identity verification.

Face Biometric Verification

We implement robust biometric technology to enable a more seamless identity verification.

Liveness Detection

We apply global top-ranked liveness detection to prevent identity fraud and theft.

Document ID verification

We use OCR to extract customer information from an ID card, to support fully automated identity verification.

Demographic Check

We compare demographic data directly with the authoritative source to get the valid data record.

Multiplatform Integration

Our product solutions can easily be tailored to your business needs with SDK, API, Web app, and iframe integration.

The Challenge

Rupiah Cepat faced a multifaceted challenge. Despite having over 12 million app downloads and catering to 280,000 daily users, Rupiah Cepat recognized the need to streamline its customer onboarding process further. VIDA's digital identity solution, VIDA Verify, emerged as the perfect solution to meet this need, not just accelerating the onboarding process but also strengthening trust, a critical factor in the financial services sector.

Protecting their users from these fraudulent activities and maintaining the platform's integrity was paramount for the company. They had to balance providing a fast onboarding process while ensuring robust security measures to protect their customers' data and financial transactions. They needed a solution that would enhance the user experience and optimize costs.

"The current data shows that implementing VIDA’s digital identity solution has decreased the rejection rate. For example, we can confidently verify 7 out of 10 applicants due to the accuracy of their data."

Yolanda Sunaryo

CEO of Rupiah Cepat

Trusted by Companies Across Industries