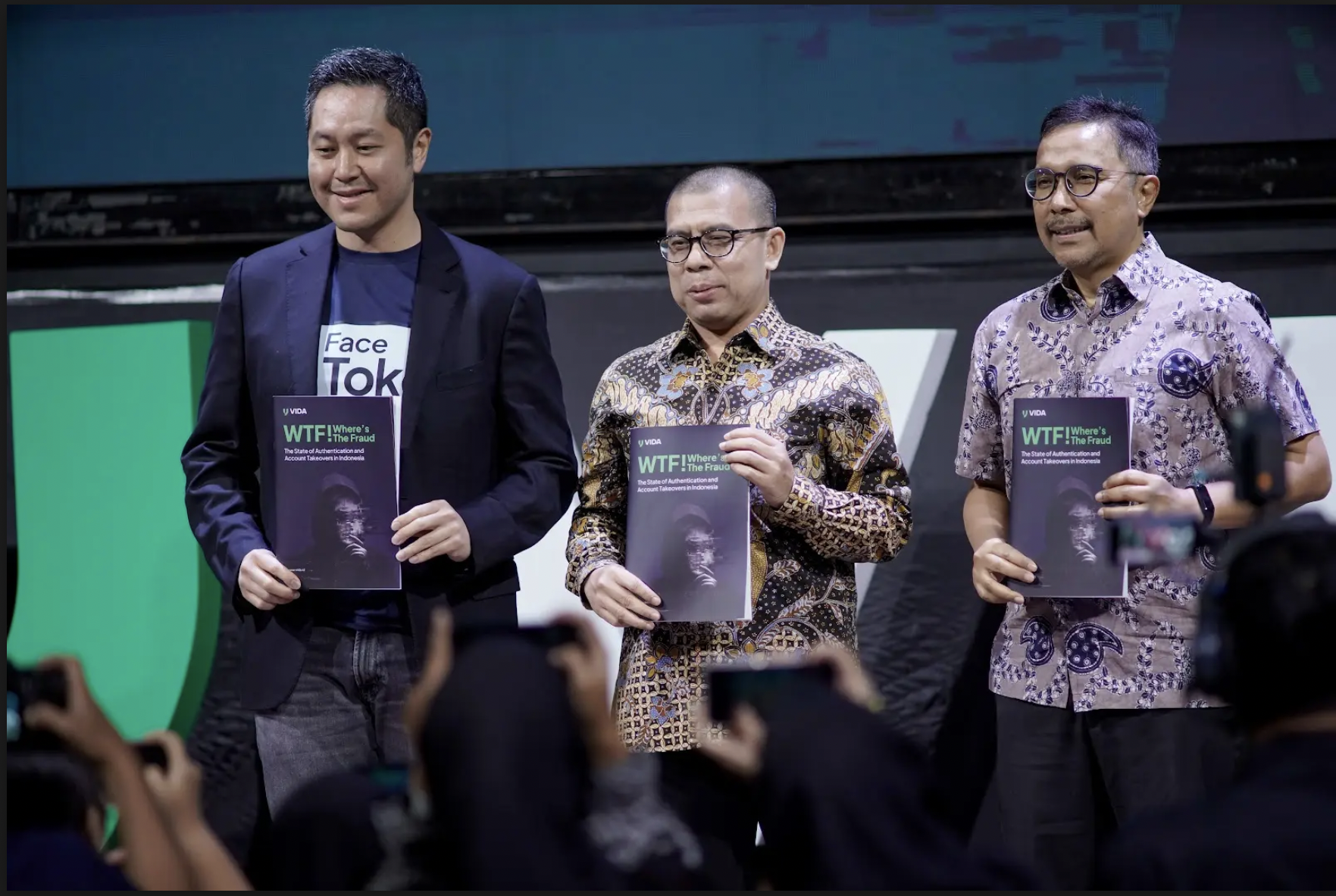

In response to the significant rise in Account Takeover (ATO) fraud, VIDA, Indonesia’s leading digital identity provider, today launched the VIDA Authentication Suite. This launch aligns with findings from VIDA’s latest whitepaper, revealing that 97% of companies in Indonesia experienced an Account Takeover incident in the past 12 months, primarily driven by phishing and smishing attacks.

This research uncovered key facts, including:

- 67% of consumers reported unauthorized transactions in their digital accounts.

- 84% of businesses faced security incidents related to SMS OTP vulnerabilities.

- 98% of businesses encountered authentication issues, yet only 9% sought alternative solutions.

- 46% of businesses lack knowledge on how to mitigate ATO risks.

"At VIDA, we believe that secure authentication should not come at the expense of user experience," said Niki Luhur, Founder and Group CEO of VIDA. "Traditional authentication methods like SMS OTP, which have been around for decades, are no longer adequate to counter today’s digital threats."

As ATO fraud continues to surge, outdated methods such as passwords and SMS OTP expose businesses and consumers to digital fraud risks. With the VIDA Authentication Suite, VIDA introduces advance technology-driven solutions that prioritize both security and user convenience.

Arwan Hasibuan, Deputy Director of Consumer Services and Capital Market Complaints, Derivative Finance, and Carbon Exchange at Indonesia’s Financial Services Authority (OJK), emphasized the urgency of addressing ATO fraud.

"From 2024 to January 2025, OJK recorded a total of 2,688 consumer complaints related to external fraud. Among these, Account Takeover (ATO) fraud is one of the most dominant and frequently reported fraud cases."

These findings highlight the critical need for collaboration across industries to combat digital fraud.

"We commend VIDA’s efforts in tackling ATO through advanced authentication solutions. As a government agency committed to consumer protection, OJK fully supports innovations in digital authentication that enhance security, improve user experience, and prevent fraud-related financial losses."

Djamin Edison Nainggolan, Executive Director of the Indonesian Payment System Association (ASPI), also emphasized the importance of secure payment systems.

"In today’s digital era, having a secure and efficient payment system is crucial. We appreciate innovative authentication measures that not only strengthen transaction security but also enhance ease of use for digital payments."

VIDA introduces Phone Token and Face Token, a VIDA Authentication Suite consisting of two key security solutions:

✔ VIDA Phone Token – Replaces SMS OTP with a cryptographic key tied to the user’s device, eliminating vulnerabilities from SMS-based OTP attacks.

✔ VIDA Face Token – Utilizes Public Key Infrastructure (PKI) security combined with facial biometrics and liveness detection, ensuring that only the rightful user can access their account.

These solutions are critical for industries that handle high-value transactions, including:

- Financial services and fintech

- E-commerce platforms

- Insurance providers

- Multi-finance institutions

"A world without passwords and SMS OTP is no longer just a vision, it can be a reality," added Niki Luhur. "We are proud to lead this transformation in Indonesia’s digital security landscape, making strong authentication accessible to everyone, simply through their phone and face."

VIDA continues its commitment to raising awareness and providing solutions for businesses facing AI-generated digital fraud.

Since April 2024, VIDA has proactively addressed digital fraud threats through a series of in-depth whitepapers:

- April 2024: VIDA introduced Indonesia’s first whitepaper on AI-generated fraud: "What The Fake! Are Indonesian Businesses Ready to Combat AI-Generated Deepfake Fraud?" – Highlighting the threat of deepfake fraud and Indonesia’s business readiness to counteract it.

- September 2024 – VIDA released another critical whitepaper: Where’s The Fraud: Protecting Indonesian Businesses from AI-Generated Digital Fraud?" – Addressing various AI-powered fraud schemes and strategies for business protection.

- February 2025: "Where’s the Fraud? The State of Authentication and Account Takeovers in Indonesia" This latest whitepaper focuses on strategies to combat ATO and AI-driven fraud.

Through these publications, VIDA reinforces its dedication to strengthening Indonesia’s digital security.

For more information on VIDA Authentication Suite, visit https://vida.id or download the whitepaper here. VIDA is committed to leading the fight against digital fraud while ensuring that authentication remains secure, seamless, and accessible for businesses and consumers alike.

.png)

%20(1).png)